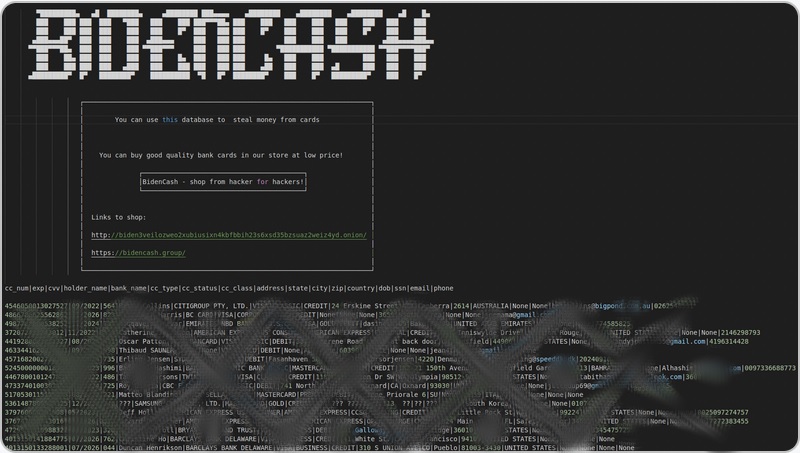

In the shadowy corners of the internet, the dark web serves as a haven for illicit activities, with marketplaces trading in everything from narcotics to stolen data. Among these, BidenCash emerged in 2022 as a notorious platform specializing in the sale of compromised credit card information and unauthorized access credentials. Its aggressive promotional tactics and expansive data dumps quickly garnered attention from cybercriminals and law enforcement alike.

Origins and Operations of BidenCash

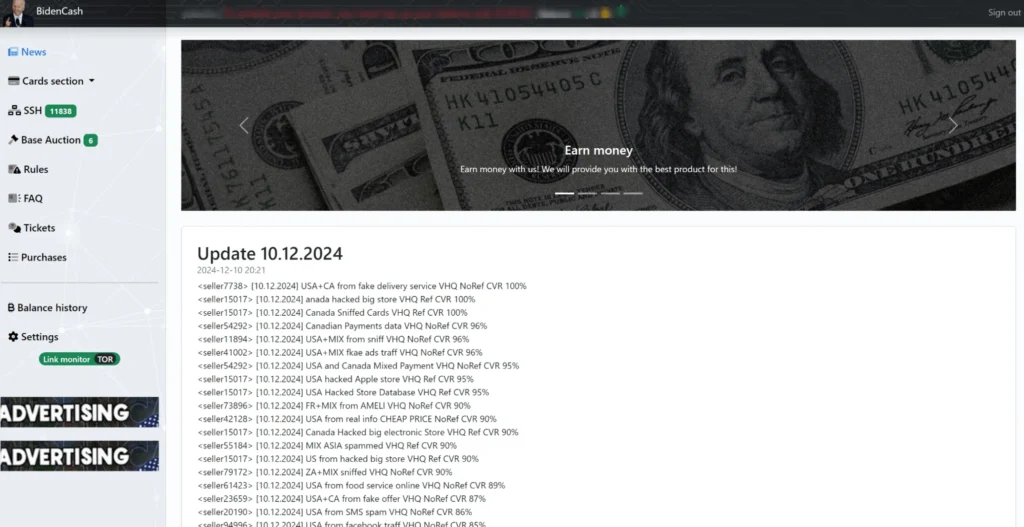

Launched in June 2022, BidenCash positioned itself as a prominent player in the underground economy. The marketplace offered a user-friendly interface, allowing buyers to purchase stolen credit card details, including full card numbers, expiration dates, CVV codes, and associated personal information. Prices varied based on the perceived value of the data, with some records sold for as little as \$2.

Beyond credit card information, BidenCash expanded its offerings to include SSH access credentials, providing buyers with unauthorized entry points into servers worldwide. This diversification underscored the platform’s adaptability and its operators’ intent to cater to a broad spectrum of cybercriminal needs.

Data Dumps as Marketing Strategy

BidenCash’s notoriety wasn’t solely due to its inventory but also its unconventional marketing strategies. To commemorate its one-year anniversary in February 2023, the platform released a data dump containing over 2 million compromised credit and debit card records on a Russian-speaking darknet forum. This wasn’t an isolated incident; subsequent dumps included:

- October 2022: Release of 1.2 million credit card records.

- December 2023: Leak of 1.6 million credit card records.

- April 2025: Exposure of over 910,000 credit card records, shared openly through clearnet file-hosting services.

These data dumps served dual purposes: attracting new users by showcasing the platform’s vast data reserves and asserting dominance in the competitive dark web marketplace landscape.

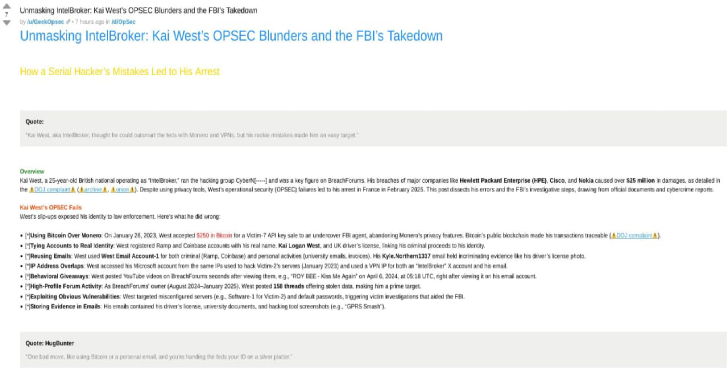

Law Enforcement Crackdown

The audacity of BidenCash’s operations didn’t go unnoticed. On June 4, 2025, a coordinated international law enforcement operation led by the U.S. Secret Service and the FBI, with support from the Dutch National Police, The ShadowServer Foundation, and Searchlight Cyber, successfully seized multiple domains associated with BidenCash. Visitors to the platform’s dark web domain were met with a banner indicating the site’s seizure due to its involvement in illegal activities.

This takedown marked a significant victory in the ongoing battle against cybercrime, disrupting one of the most active marketplaces trafficking in stolen financial data.

Implications and the Broader Cybercrime Landscape

The operations of platforms like BidenCash have profound implications:

- Financial Losses: Global credit card fraud losses are projected to escalate from \$34 billion in 2022 to \$43 billion by 2026, a trend exacerbated by the activities of such marketplaces.

- Data Proliferation: The repeated leaks and sales of compromised data increase the risk of identity theft, unauthorized transactions, and other forms of financial fraud.

- Cybersecurity Challenges: The availability of SSH credentials and other access points facilitates further cyberattacks, including ransomware deployments and data breaches.

While the shutdown of BidenCash represents progress, the persistent demand for stolen data ensures that similar platforms will continue to emerge, necessitating ongoing vigilance and international cooperation in cybersecurity efforts.

Conclusion

BidenCash’s trajectory from its inception to its eventual dismantling highlights the dynamic and resilient nature of cybercriminal enterprises. As technology evolves, so too do the methods employed by threat actors. Combating such threats requires a multifaceted approach, combining technological defenses, public awareness, and robust international law enforcement collaboration.

Frequently Asked Questions

Q1: What was BidenCash?

A1: BidenCash was a dark web marketplace launched in 2022, specializing in the sale of stolen credit card information and unauthorized access credentials.

Q2: How did BidenCash attract users?

A2: The platform released large datasets of compromised financial information for free, serving as a promotional tactic to showcase its inventory and attract cybercriminal clientele.

Q3: What led to the shutdown of BidenCash?

A3: A coordinated international law enforcement operation, involving agencies like the U.S. Secret Service and the FBI, seized multiple domains associated with BidenCash in June 2025.

Q4: What risks did BidenCash pose to individuals?

A4: By facilitating the sale of stolen financial data, BidenCash increased the risk of identity theft, unauthorized transactions, and broader cyberattacks targeting individuals and organizations.

Q5: How can individuals protect themselves from such threats?

A5: Regularly monitoring financial statements, using strong and unique passwords, enabling two-factor authentication, and staying informed about data breaches can help mitigate risks associated with stolen data marketplaces.